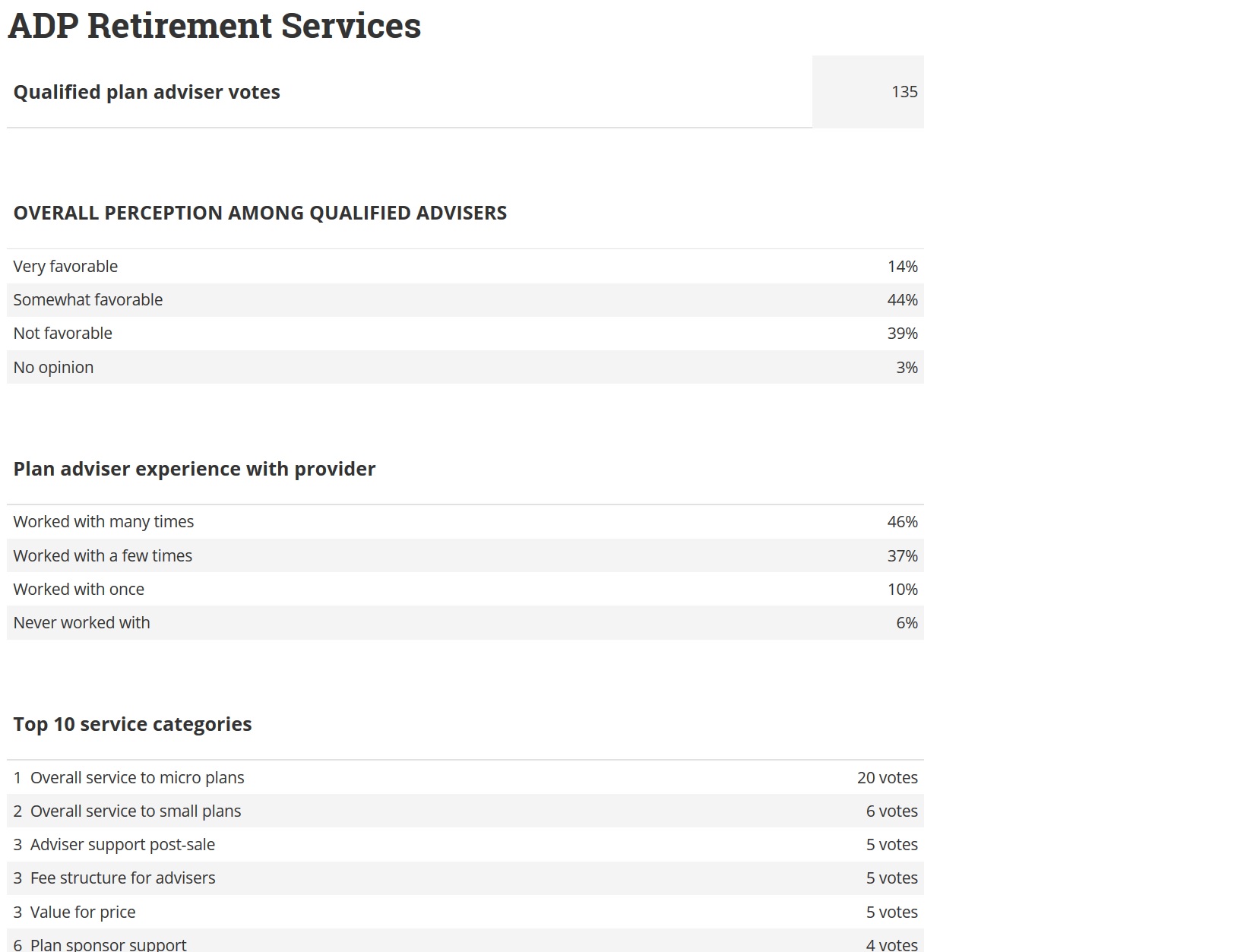

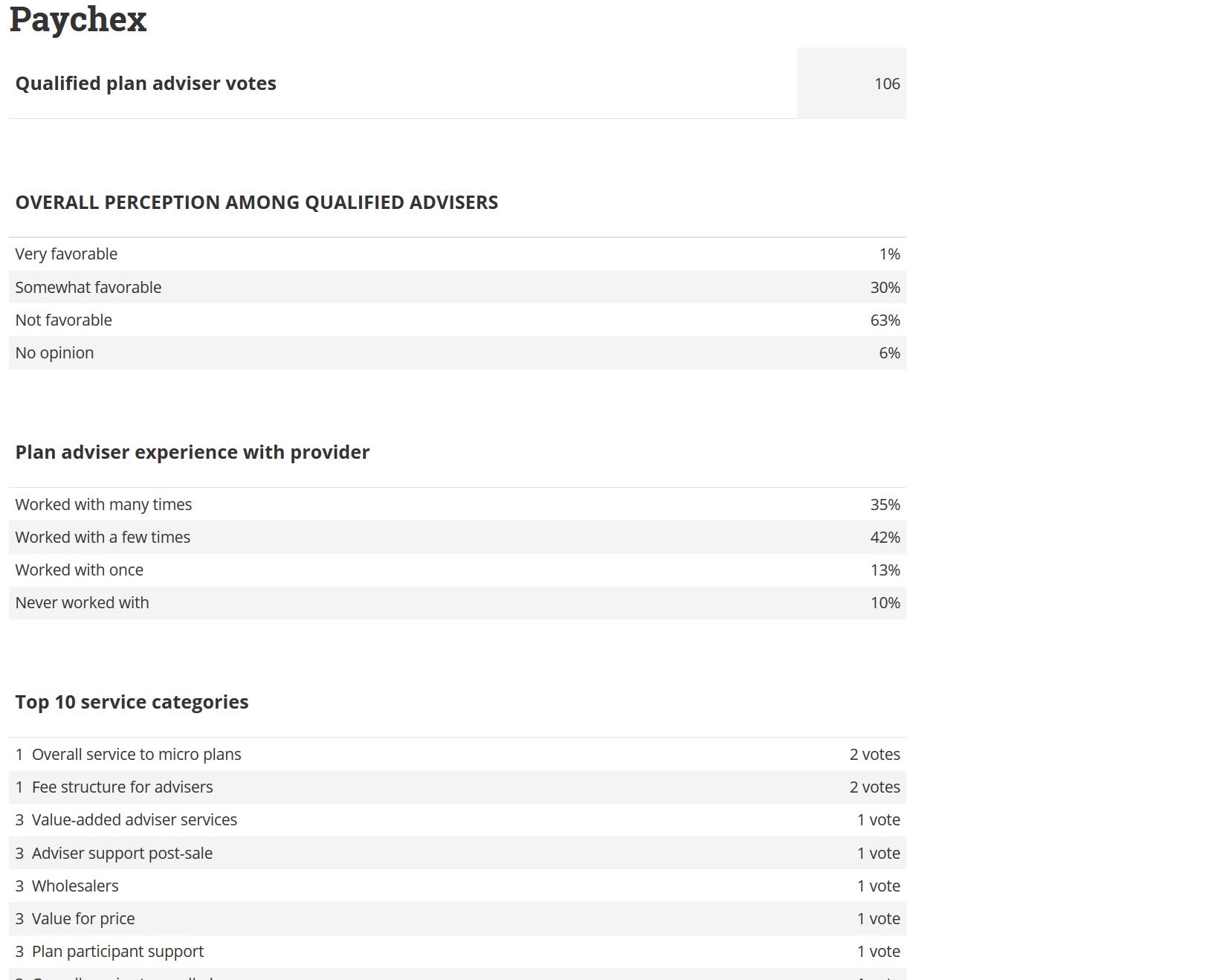

Plan Advisor Magazine Survey – Voted Mostly “Somewhat Favorable and Not Unfavorable” Ratings.

Do you think a one-stop shop is the easiest, cheapest and best way to go for both Payroll and 401(k) services, think again. Plan Advisor Magazine (www.PlanAdvisor.com) is a well-respected publication that covers the retirement investment community and the advisors that support it. They have several survey’s throughout the year to monitor all facets of 401(k) and similar retirement plans for companies, non-profits and governments. The following data came from an article in their September/October edition titled, “2017 Plan Advisor Retirement Plan Advisor Survey”.

Below is their Methodology for this survey (copied directly from the article):

This August and September, approximately 15,000 advisers were asked to respond to the 2017 PLANADVISER Retirement Plan Adviser Survey, developed by this magazine’s editorial and research teams. Survey questions pertained to the size and scope of advisers’ qualified plan business, practice management, compensation and client service, as well as their assessments of investment managers, mutual funds and defined contribution (DC) plan providers. At the close of the survey, 325 complete responses had been received from retirement plan advisers. To qualify to supply opinions on mutual fund families and specific mutual funds, an adviser had to be personally involved in evaluating and recommending fund choices in an advisory capacity to qualified plan clients; 212 advisers met this criterion. To evaluate DC plan providers, advisers had to answer affirmatively that, acting in an advisory role, they personally evaluate and recommend these providers for qualified plan clients; 205 advisers did so. In addition, an adviser needed to have worked with a DC plan provider more than once for his favorability rating of that recordkeeper to count.

From our (Atlas) experience working with current clients and talking to many prospective clients who have the bundled services from ADP or Paychex, we were not surprised by these results and was hoping they would expand on more of the reasons why they rated these two providers the way they did.

The typical feedback we hear from companies that have one or the other are as follows (not in any particular order):

- Outsourcing of services – Both ADP and Paychex outsource their investment services so there is a 3rd Party involved to try and understand how they get paid and how they service. Communication across all parties is problematic in this setup. Very difficult to change this component of your overall plan providers if you aren’t happy.

- Understanding of Fees – The 408(b)(2) form is a mandatory form that ALL providers must disclose. It is a complete disclosure of fees, who gets them and how much. This form should be readily available but we have usually found it can be quite difficult to obtain and sometimes buried in the back of other documentation not clearly identified. You need to know where it is and how to get to it quickly. Plus you should review it anyway.

- They do not offer ETFs (Electronic Traded Funds) as an option over Mutual Funds in the 401(k) asset lineup. This would significantly reduce fees and increase the long-term performance of the participants accounts. Too many providers bundle administrative fees into the funds so the Plan Sponsor pays less and puts the fee burden on the participants. This makes the Plan Sponsor fees appear less, but in reality the participant is paying for them. Many times this is NOT fully disclosed or clearly explained in the 408(b)(2) fee schedule or in the Summary Plan Description document. Look at it as “just moving sand around in the sandbox”. Someone has to pay them.

- Fiduciary Compliance – unfortunately this is an afterthought. All you need is one participant compliant and a filed citation or some other reason for the DOL to initiate an audit, then all of the sudden Fiduciary Compliance becomes important. You need to know who your 3(38) Fiduciary is (Represents the Plan Sponsor; sets up the Asset Lineup, Runs the Investment Committee meeting, assists in Plan Design, etc.). You also need to know who your 3(21) Fiduciary is (Represents the Participant; Provides investment and financial education and guidance along with retirement ready planning, etc.). You need a complete and comprehensive audit on your documentation to make sure communications and other important documents are filed and archived regularly.

You may wondering why we wrote this article and possible saying this is a way of disparaging the competition. If you are using ADP or Paychex then obviously you can draw your own conclusions. We provided independent research from a reputable publication and shared our experience with the companies we have come in contact with that are using or have used ADP and/or Paychex in the past. Their business model is quite clear, get as much of your business under their roof as possible, even if they don’t perform some or most of the services or do it well or “favorable” as the survey suggests from the publication.

If you are a part of your company 401(k) team, a director or an owner in the company, you have a fiduciary responsibility to the 401(k) plan. You need to be a part of the Investment Committee meetings and sign off that you know your fees are reasonable by DOL standards and the assets are performing as expected and while reviewed regularly. If you have turned a blind eye or just accept someone else’s opinion without a thorough review, you could be at risk. Don’t believe us, ask an ERISA attorney, contact the DOL for what your responsibilities are to the company and the plan. You would be quite surprised on what your involvement and responsibilities should be.

We are not fear mongers or trying to incite a riot. But in the end, isn’t it important and helpful to the overall health to the plan to offer the best and most diverse Asset Lineup with the most reasonable fees and equal to or greater performance to their peers? Remember, participants are getting smarter and need to know that the assets have the lowest fees possible and they are not paying a lion share of the administrative fees in the plan because it will affect their long-term performance and the DOL will frown upon this approach. It’s also important to know what is your fiduciary responsibility and what are the checklist items throughout the year that you need to be aware of.

This article is provided as an opinion of Atlas along with information from a reputable publication. By the way, you can go back over the years to see how this data has either changed or stayed the same. You should be doing reviews on a regular basis anyway. Remember, a 401(k)/403(b) plan is mean to Attract, Retain, Reward and Motivate employees. Some may look at it as the most important company benefit other than healthcare. You need to be aware and more informed to what is important to you, your company and most importantly, your employees (participants).

Authored by – Ronald Lang, Principal of Atlas 401(k) Retirement Specialists – www.Atlas401kPlans.com Contact us for a 401(k) Fiduciary Review and Benchmark Analysis – 888.403.9400